Income Tax raid: 14 KG gold, 3.89 crore cash, tax evasion of Rs 150 crore. Treasure found at former BJP MLA’s house

The Income Tax Department had raided three places in Sagar, Madhya Pradesh. In this action, the Income Tax team has also found documents of big tax evasion and benami property. The Income Tax team is now preparing to issue summons to the concerned and take statements.

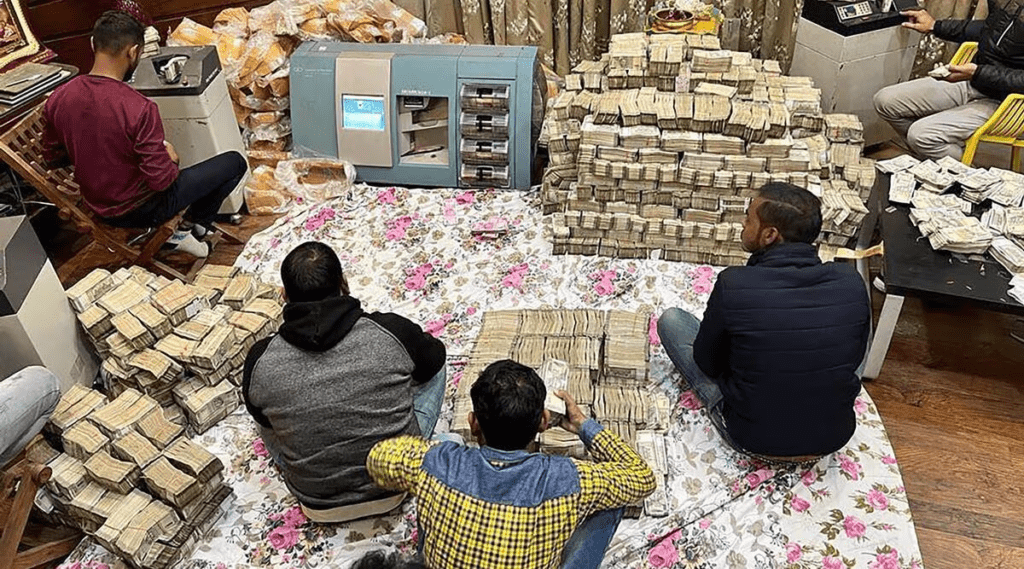

The case of gold and cash worth crores found from the places of former constable of Transport Department Saurabh Sharma in Bhopal, the capital of Madhya Pradesh, has not cooled down yet; now 14 kg of gold has been recovered from the places of former Bharatiya Janata Party MLA in Sagar of the state. Cash worth Rs 3 crore 80 lakh has also been recovered in the raid by the Income Tax Department team. A case of tax evasion of crores of rupees has also come to light.

A stock of crores of rupees has been found in the Income Tax Department’s action at the house of former BJP MLA Harbansh Singh Rathore of Banda in Sagar district. The team found 14 kg of gold and Rs 3.80 crore in cash during the investigation. Tax evasion of Rs 150 crore has also been detected. Along with this, property worth more than Rs 200 crore has also been detected during the investigation.

Tax evasion of Rs 150 crore

Income Tax raid on the premises of BD and construction businessman former councillor Rajesh Kesarwani and former BJP MLA from Banda Harbansh Singh Rathore in Sagar has brought out tax evasion of about 150 crore. Along with cash, gold has also been recovered from the premises of both during the action of the Income Tax Department. Seven luxury cars were also seized from the place of former councillor and businessman Rajesh Kesarwani. These are in someone else’s name but were used by the Kesarwani family.

Raids are still underway.

Income Tax Department teams raided the former MLA’s locations in Sagar district on Sunday. In this raid, the Kesarwani brothers, two moneylenders, and the firm of an officer posted in the Cantt Board were also taken into investigation. Income tax action on the former MLA’s places has ended, but it is still happening at the Kesarwani brothers’ place. The former MLA also has a bidi business.

Opposition attacks

The Rathore family has been a big businessman in the Sagar division for decades. Former MLA Harvansh Rathore’s father, Harnam Singh Rathore, has been a minister. Therefore, this is a family with a lot of influence in politics, too. The opposition is attacking after crores of rupees worth of money was found at the former BJP MLA’s places. State Congress President Jeetu Patwari shared the newspaper’s news on social media, and he added, ‘Daaku-dacoits have ended in Madhya Pradesh, but BJP leaders have filled their void.’